Digital wallets are rapidly changing how we pay for goods and services. The global digital payments market is expected to grow from $5.44 trillion in 2020 to over $11.29 trillion by 2026. As more consumers shift to contactless payments and mobile transactions, companies like Apple, Google, PayPal and Square are vying to become our default payment platforms.

But with data breaches on the rise, how safe are these new digital financial ecosystems? This article analyzes the current state of digital wallet security, emerging technologies improving safety at Spinbit, and steps you can take to protect your money in an increasingly cashless world.

The Convenience and Vulnerability of Digital Wallets

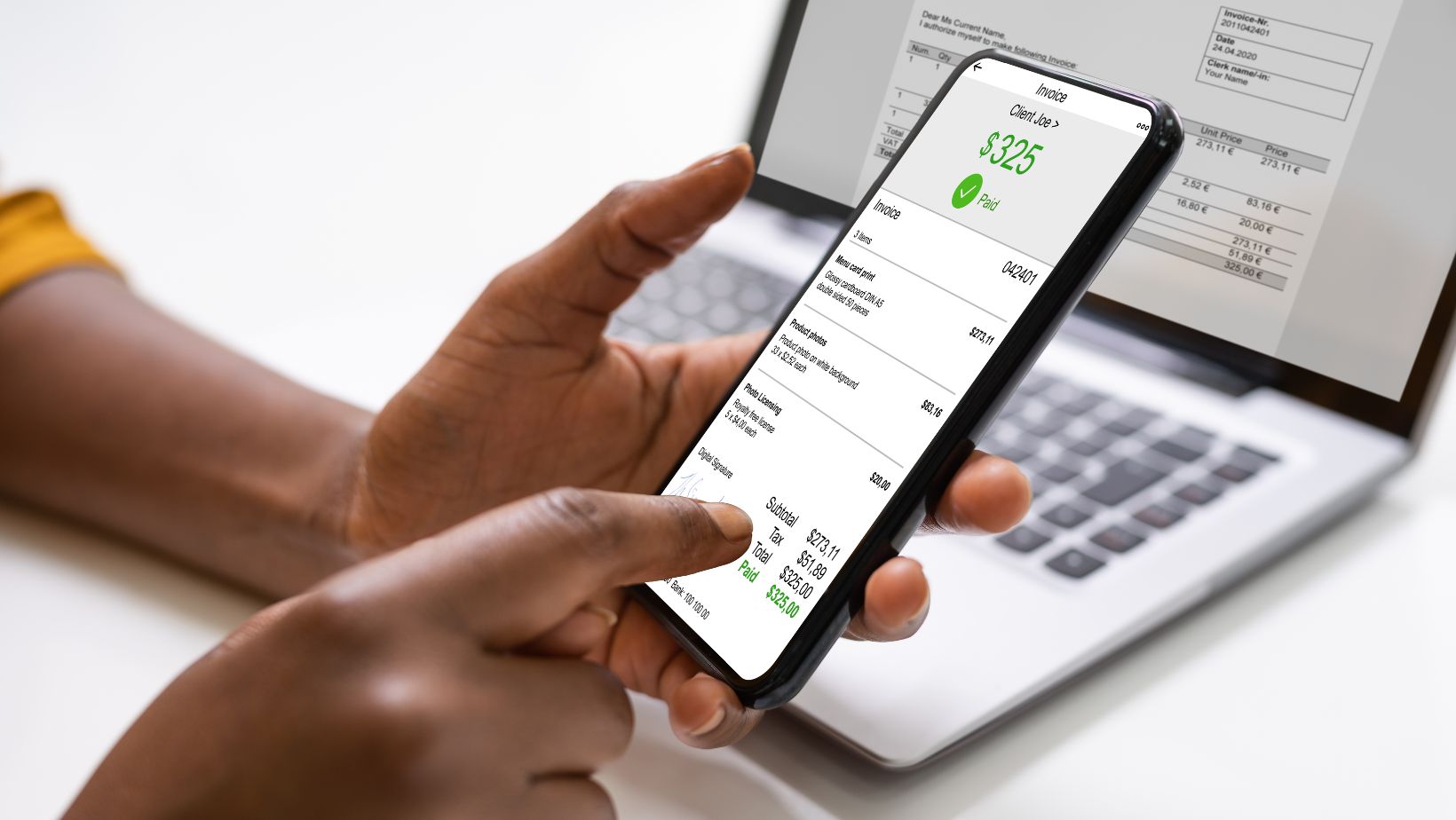

Digital wallets link payment information across devices for easy spending without reaching for your physical wallet. Popular varieties include:

- Mobile wallets like Apple Pay and Google Pay are connected to your smartphone.

- Online wallets like PayPal and Amazon Pay to quickly pay at checkout.

- Cryptocurrency wallets for sending and receiving digital coins.

While digital wallets offer unparalleled convenience, they also introduce new cybersecurity threats:

- Fraudulent transactions if your login credentials are compromised.

- Identity theft is when hackers obtain sensitive personal information.

- Digital pickpocketing through RFID/NFC scanning.

To understand the rising concern, let’s look at some statistics:

|

Type of Threat |

Percentage Affected |

|

Payment card fraud |

33% suffered some kind |

|

Identity theft |

14.4 million victims in 2019 |

|

Contactless theft |

$30 million stolen via Apple Pay & Google Pay |

Advancing Security Standards in Digital Transactions

Thankfully, digital wallet platforms and financial institutions are developing sophisticated tools to block fraud and better verify users:

- End-to-end encryption secures payment data throughout each transaction.

- Biometrics like fingerprint, face, or iris scanning provide exclusive user access.

- Tokenization encodes financial information into random strings that are useless to hackers.

- Artificial intelligence spots irregular purchase patterns indicative of fraud.

Blockchain networks also show great promise for improving security and reducing interchange fees. For example, Ripple uses immutable ledger technology and the XRP cryptocurrency to facilitate global bank transfers in seconds.

As these technologies advance, global standard-setting organizations work to ensure broad compatibility between digital wallets from different providers. Groups like EMVCo allow mobile wallets from various platforms to make contactless payments at point-of-sale systems using the same NFC protocols.

Such cross-compatibility will enable customers to easily switch between digital payment apps and fund transfers, depending on the situation. This drives market competition to improve offerings around security, rewards programs, currency exchange rates, customer service and other attributes.

5 Tips to Avoid Digital Pickpocketing

While leading technology providers have invested billions into security initiatives, fraud still occurs far too frequently. Until recently, schemes targeted credit cards and bank accounts. However, growth in digital transactions now attracts hackers to mobile payment platforms holding your financial data.

Here are 5 tips to avoid digital pickpocketing as you increasingly rely on digital wallets:

- Only download apps from official stores like Apple’s App Store or the Google Play Store. Avoid sideloading apps that bypass safety reviews.

- Carefully check app permissions before installing. Make sure access requests match the expected functionality.

- Keep all devices and apps fully updated to benefit from the latest security patches. Turn on automatic updates if available.

- Enable two-factor authentication using biometrics like face or fingerprint recognition. This prevents unauthorized logins, even with your password.

- If your device offers lock screen notifications, disable viewability for messages from financial apps to prevent shoulder surfing.

The Future of Digital Payments

As digital wallets improve security and offer integrated loyalty programs, they may one day render physical credit cards obsolete. Imagine a world where you can leave your wallet at home and pay for everything with your watch, rings, or another wearable device.

In fact, leading financial analysts predict mobile transactions will overtake cash, checks, and physical cards worldwide by 2024. Mastercard, Visa, Apple Pay, Alipay, and other payment processors now face a significant market opportunity to shape our transition towards a cashless global economy.

While fraud persists as a nagging issue, continued security advancements provide hope for reducing risks over time. Consumers increasingly recognize the safety and rewards provided by seamless digital transactions.

The remaining question is: Which platforms will dominate the future of payments? With Big Tech and FinTech battling for position, one thing is certain – the winning digital wallets will become instrumental to our daily lives as cash fades further out of circulation.